Trade shows and trade publications are attractive not only to other industry buyers, but also to investment groups. Private equity funds discovered the value of business-to-business media over the past ten years, and they continue to acquire companies to build large media corporations. This consolidation will continue since it is a proven method of increasing sales, earnings and return-on-assets.

Market Multiples

In almost any market environment, there is a desire for buyers to find quality trade shows and magazines to acquire. Valuation multiples typically reset each quarter and can fluctuate significantly.

Average selling prices for trade shows, trade publications and media companies have been volatile in recent years, but they are now holding steady at their current levels.

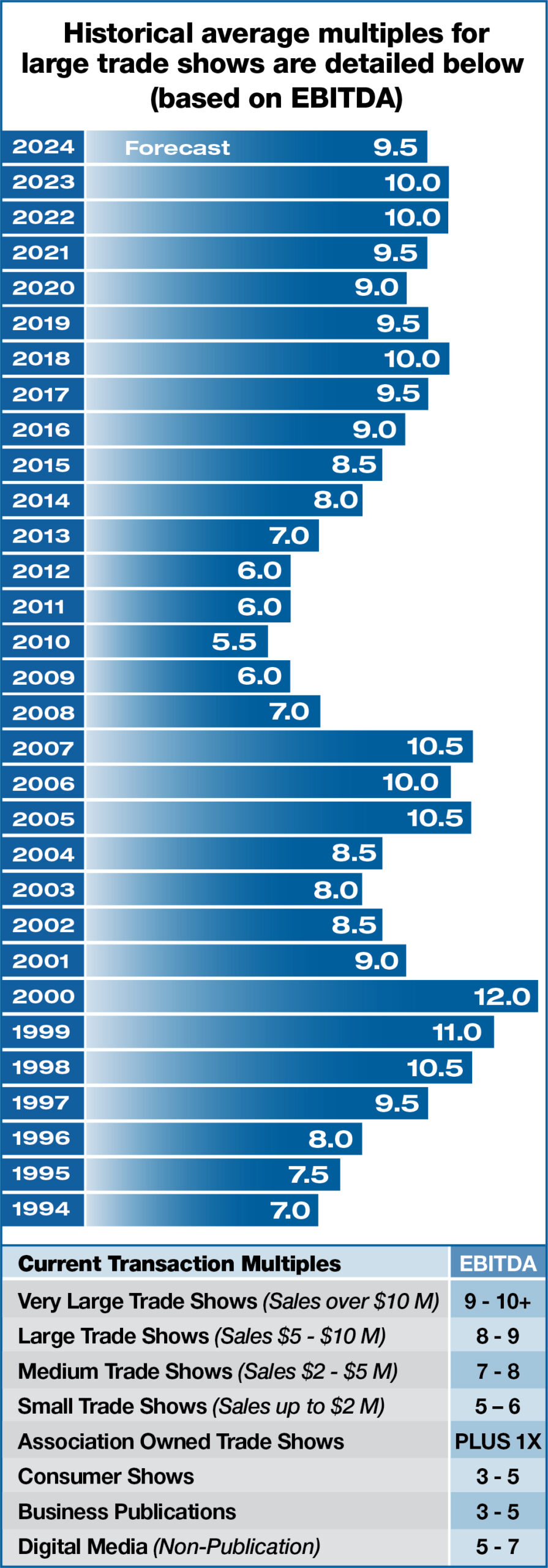

Typically, the selling price is determined by multiplying a company’s earnings before interest, taxes, depreciation and amortization (EBITDA) times a transaction multiple. This multiple is determined by incorporating performance trends, industry trends, historical growth rates, sales volume, competition, market expansion opportunities, new product launches, age of shows/magazines, depth of management, owners’ continuation and retention of clients.

The transaction multiple increases as the size of the show/magazine increases. In special cases where the company has an inconsistent earnings history or is not currently profitable, sales are used instead of EBITDA to apply the transaction multiple.

See the graph below for a historical reference of market multiples for the trade show industry since 1994 as well as the current market multiples in today’s environment.

The multiple ranges above are for businesses with positive revenue and earnings trends. These multiples get reduced appropriately when the revenue or profit trends are only moderate or negative. Conversely, multiples above can increase when revenue and profit trends are higher than general market conditions.

Caution: These are only general market guidelines – each asset is valued on literally dozens of independent factors. It would be incorrect to value an asset solely on the revenue guidelines listed above.

Other factors that should be considered are: trends of revenues, profits and attendance, pricing power, customer retention, opportunities for growth, competition, staffing, traffic density, yield and many others.

Also, trade shows that generate most of their revenues from exhibits are valued differently from those that generate most of their revenues from conferences.

Association owned trade shows command a premium to the levels above and in most cases, the multiples are increased by 1 X or more.

Business Valuation Services

We offer formal business valuation services for trade shows, consumer shows and trade publications. Clients retain us for this purpose when they want to have a formal valuation for determining the true market value of these related assets for many reasons: (1) to decide if they want to proceed with a sale on the open market, (2) to determine a valuation for internal equity share transfers or (3) to determine a value for tax or estate planning purposes.

Determining company valuation and transaction multiples is not an exact science. This is why it is so important to work with an advisor who is an industry expert and is on top of the trends. Our unique methodology and complex formula for determining a realistic market price range for any media property has been developed over time and has proven successful for many satisfied clients.

Contact Us

Contact Us for a confidential discussion of your company, individual show or magazine. We will offer our opinion on the value of your company, the right time to sell in your market, and what you can expect in terms of selling price.

Contact Us Today!